Money & Banking

Stunning prediction for Aussie homeowners in wake of Trump's trade war

Australian homeowners could see their mortgage repayments tumble by as much as $9,000 annually if Donald Trump’s escalating trade war triggers a global recession, with experts predicting a double interest rate cut as soon as May.

As stock markets worldwide reel from the fallout of Trump’s latest trade moves – with China now deeply involved – fears of a US recession are intensifying. On Monday alone, around $100 billion was wiped from the Australian share market amid growing global trade tensions.

Yet, for Australian mortgage holders, there could be a surprising silver lining. According to ANZ, homeowners with a $600,000 loan could save between $76 and $156 a month under four forecasted rate cuts of 0.25 per cent each over the next year.

For those with a $500,000 mortgage, repayments could fall by about $76 a month, while families with larger $1 million loans could pocket savings of around $153 monthly – amounting to a staggering $9,000 annually.

ANZ’s chief economist, Richard Yetsenga, said the Reserve Bank of Australia (RBA) is expected to cut rates in May, July and August.

“We now expect the RBA to ease in May, July, and August – 25 basis points at each meeting,” Yetsenga said, adding that a double rate cut of 50 basis points in May is not off the table if global growth deteriorates further.

Earlier this year, the RBA trimmed the cash rate by 25 basis points in February, offering homeowners with variable rate loans some relief – saving them around $100 to $150 a month, or potentially more than $1,200 annually.

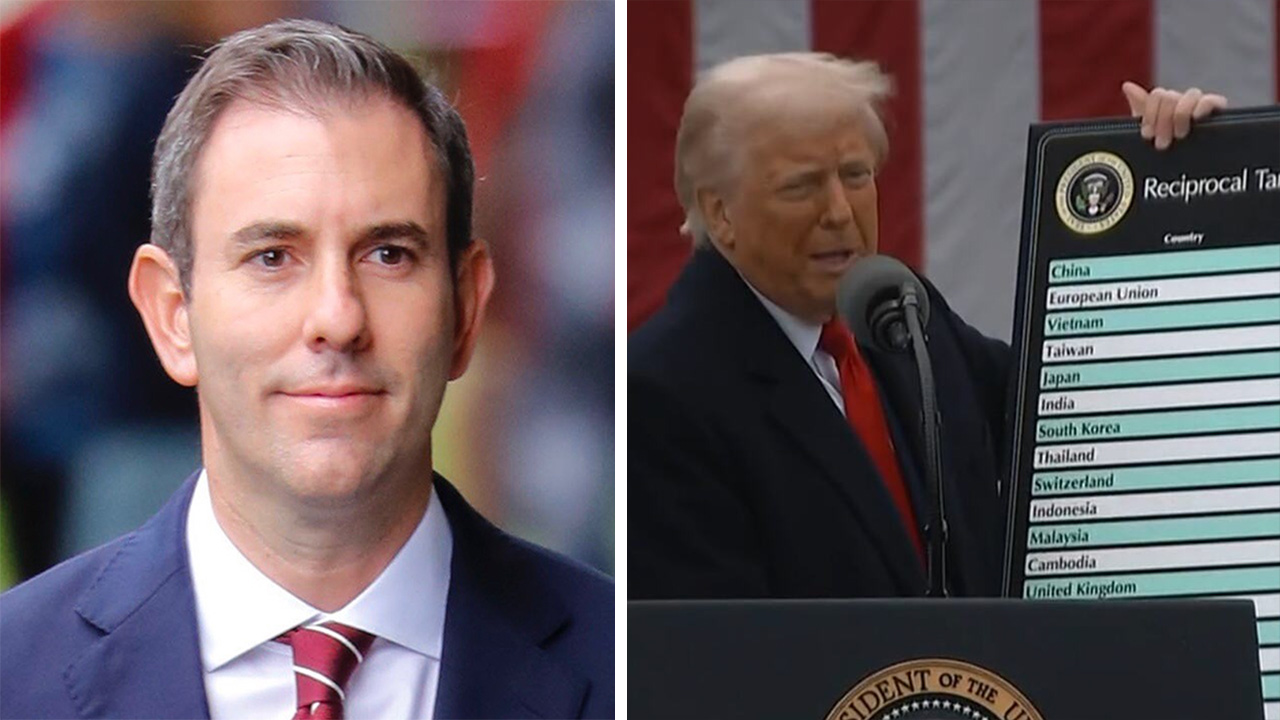

In a stunning prediction, Treasurer Jim Chalmers echoed these forecasts while hinting at up to four interest rate cuts this year, with the potential for a significant 50 basis point cut as early as next month.

“The next Reserve Bank interest rate cut in May might be as big as 50 basis points,” Chalmers said. “Forecasting is difficult enough in stable times, but even more so in uncertain times.”

Despite the grim outlook for markets, Chalmers offered reassurance, especially for Australians nearing retirement whose superannuation balances are being rocked by market volatility.

“Everyone with a super fund, everyone with shares, probably every Australian, is watching the global markets with trepidation,” Chalmers said. “But we are better placed, better prepared, and Australians should take comfort in that.”

The Treasurer also voiced concerns about the impact of the trade war on Asia, noting that tariffs are hitting countries like Malaysia, Thailand and Vietnam particularly hard, while China’s economy may prove more resilient. ANZ expects Asian currencies to take the brunt of the adjustment as the tariffs unfold.

While uncertainties loom large, for Aussie homeowners at least, the prospect of falling interest rates offers some financial relief in an increasingly unpredictable global economy.

Images: Youtube