"Get a grip": Retirees roasted over tone-deaf pension question

A pair of retirees - and their significant others - have found themselves at the centre of a new online debate, all because of their submission to one financial advice column, and its circulation on social media.

Both retirees - each with millions of dollars to their names - submitted their concerns to the Sun Herald’s George Cochrane, hoping for financial advice and a solid strategy moving forward with their respective retirements.

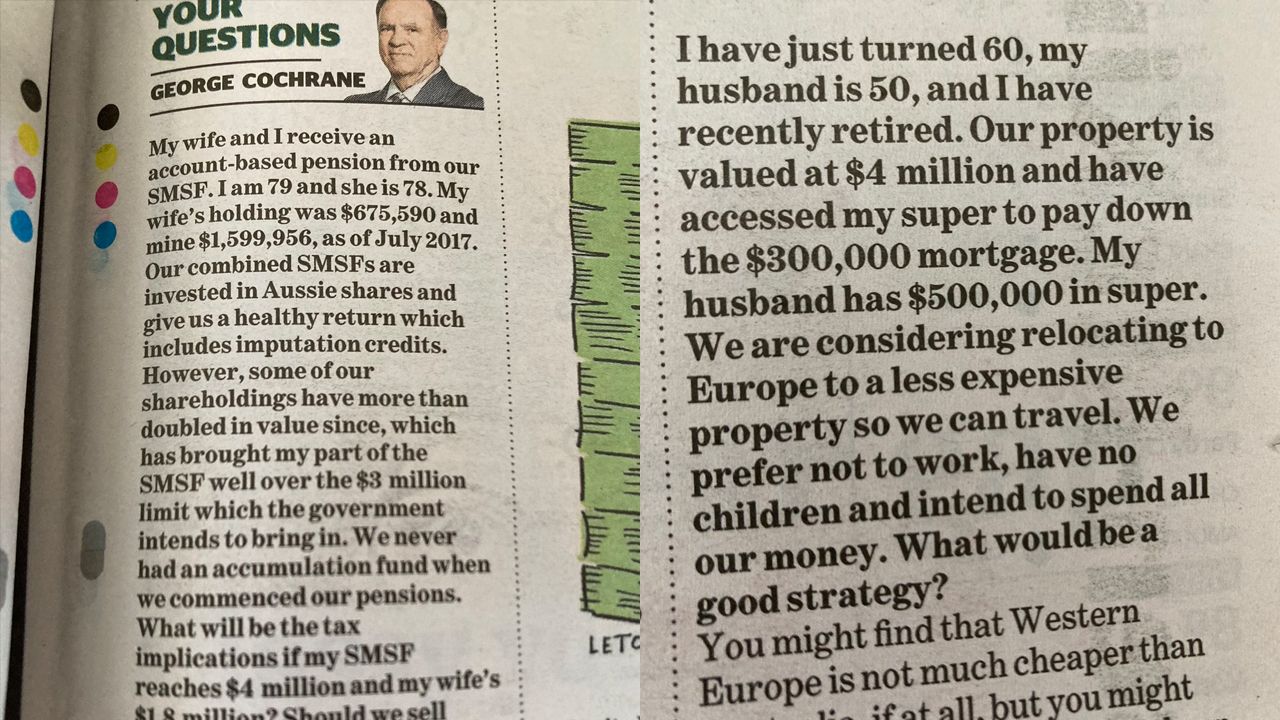

The first request saw a 78-year-old man and his 79-year-old wife ask if they should look into selling some of their shares in order to stay below a threshold.

The couple were receiving an account-based pension from their self-managed super fund, with a combined total of nearly $2.3 million - he had $1,5999,956 and she had $675,590 as of July 2017.

Their combined funds were invested in Australian shares, they noted, and gave them a “healthy return which includes imputation credits”. They went on to share that since 2017, some of their shareholdings had “more than doubled in value”, and that the husband’s contribution to their fund had exceeded “the $3 million limit which the government intends to bring in.”

“What will be the tax implications if my SMSF reaches $4 million and my wife’s $1.8 million?” they asked. “Should we sell some of our shares to stay below the $3 million threshold?”

The second request came from a 60-year-old woman on behalf of herself and her 50-year-old husband, in which she revealed they had property valued at $4 million, and that they’d accessed her super to pay their $300,000 mortgage. His super, meanwhile, still contained half a million.

Additionally, the two had plans to relocate to Europe to a “less expensive property” in order for them to spend more time - and have more funds to put towards - travelling.

“We prefer not to work,” she shared, “have no children and intend to spend all our money. What would be a good strategy?”

Advice was given, but the column’s wave of response came when The Guardian’s deputy news editor Josephine Tovey shared it to her Twitter, sharing her thoughts on the “generational inequality” it represented, and closing her take with the line “what problems to have”.

Many - mostly those from younger generations, primarily millennials - were quick to side with Tovey, unable to wrap their heads around the idea that the couples’ problems were valid ones.

“Oh no. I have TOO MUCH MONEY. What to do, what to do,” one user wrote.

“‘I have more money than I know what to do with. Please help’,” another contributed.

“I'd ‘prefer not to work’ too but here I am,” one quipped.

And as someone else put it, “more than $4 million in assets but too cheap to pay for professional advice. Nothing could be more boomer than this.”

“I think that there is huge inequity and variance among Boomers - often depending on the presence or absence of intergenerational wealth,” another user noted. “Ditto with millennials cos of [the] same reason”.

However, for every person who was condemning them, another was prepped and ready to come to their defence.

“Dear oh dear. Tall poppy syndrome strikes again - Australians are so good at trying to tear down the successful,” one said. “Seriously, get a grip everyone. Good luck to them and I hope they enjoy their respective retirements.”

“My partner and I don’t have kids, we live in a modest house and save as much as we can so that we can retire early and travel, we are not landlords, we didn’t inherit any money but we should have about $2 million to retire on, we are working class,” one shared, “doesn’t seem wrong to me.”

“They obviously worked hard and earnt it!! Haters going to hate - but good on them - I hope in 20 years when I retire, I have problems like this too,” another wrote.

“So they have worked hard all their lives, they don’t have children and they want to travel - why is this an issue?” someone wanted to know, before adding that “they deserve to spend their twilight years in comfort.”

Images: Twitter