“It’s a nightmare”: How NSW woman took on Centrelink and won

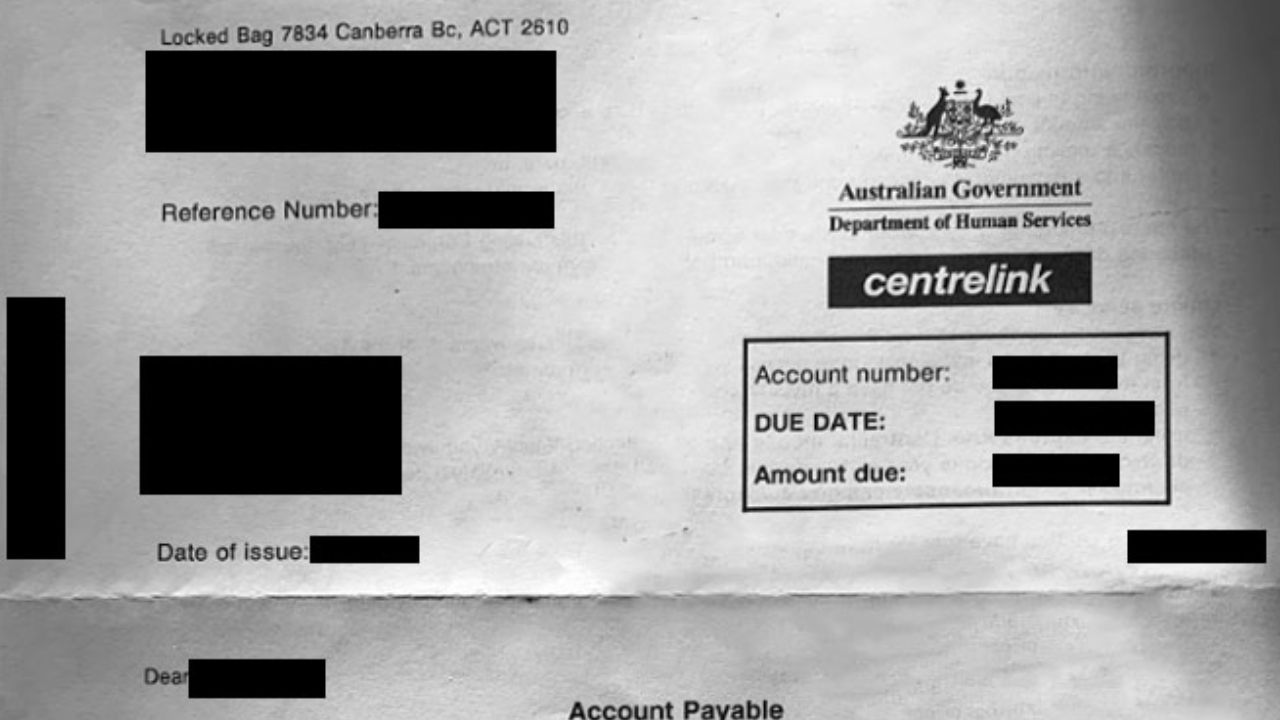

A NSW woman has revealed how she fought back a false $8,000 debt from Centrelink.

Single mother Rebecca Wright said she received a notice claiming that she had debts dating back to 2016 and 2017, when she held part-time and casual jobs in hospitality and retail while receiving the Newstart allowance and the Family Tax Benefit.

Wright said she spent “hours on end” over a two-week period examining past pay slips and cross-referencing a diary she had used to keep track of her work hours and earnings.

After re-entering her work details online, it was discovered that “around 75 per cent” of Centrelink’s claims “didn’t marry up”. Wright’s debt was reduced from nearly $8,000 to about $1,600.

She said the debt was probably still too high, but she decided to “wear it” due to the stress and anxiety from disputing the notice.

“It put me through such depression and anxiety – I was so upset because it came out of nowhere, and I had always been really particular with my reporting,” she told news.com.au.

“I’m a single mum and I was living with this debt over my head which I didn’t expect – it just put me in such a position of stress.

“I was crying and so stressed. I was panicking – I thought, ‘As a single mum, I can’t afford this’.”

She said the situation was exacerbated by “rude and unhelpful” Centrelink staff and the department’s “mind-boggling” and “confusing” reporting system.

Wright has since repaid her reduced debt. Today she works full-time and no longer receives the Newstart payment.

She urged other Australians to be wary.

“It’s just sad. It’s a nightmare for some people. People need to fact check, ask questions and fight back,” she said.

“I’m just lucky I was able to figure it out, but other people don’t know what to do – they might not be aware or they might have disabilities which means they just wear it and start paying.”

Centrelink’s controversial robodebt scheme has been criticised for issuing incorrect debt notices against Australians. According to Services Australia, the government has raised more than $15 million in debts against 9,149 people considered vulnerable over the three years the system has been in place.

The number of complainants taking part in a class action against the scheme has reached 4,000 as of last week.