"Sorry about that, kids": Baby Boomers blamed AGAIN for national woes

Australia's ongoing battle against soaring inflation is taking a toll on ordinary households, particularly young Australians, while – according to a recent News.com.au analysis – "cash-rich baby boomers and price-gouging corporations" remain largely unscathed.

This stark reality has been brought to light by financial experts and youth advocates, who point to the disproportionate impact of rising interest rates and living costs on younger generations.

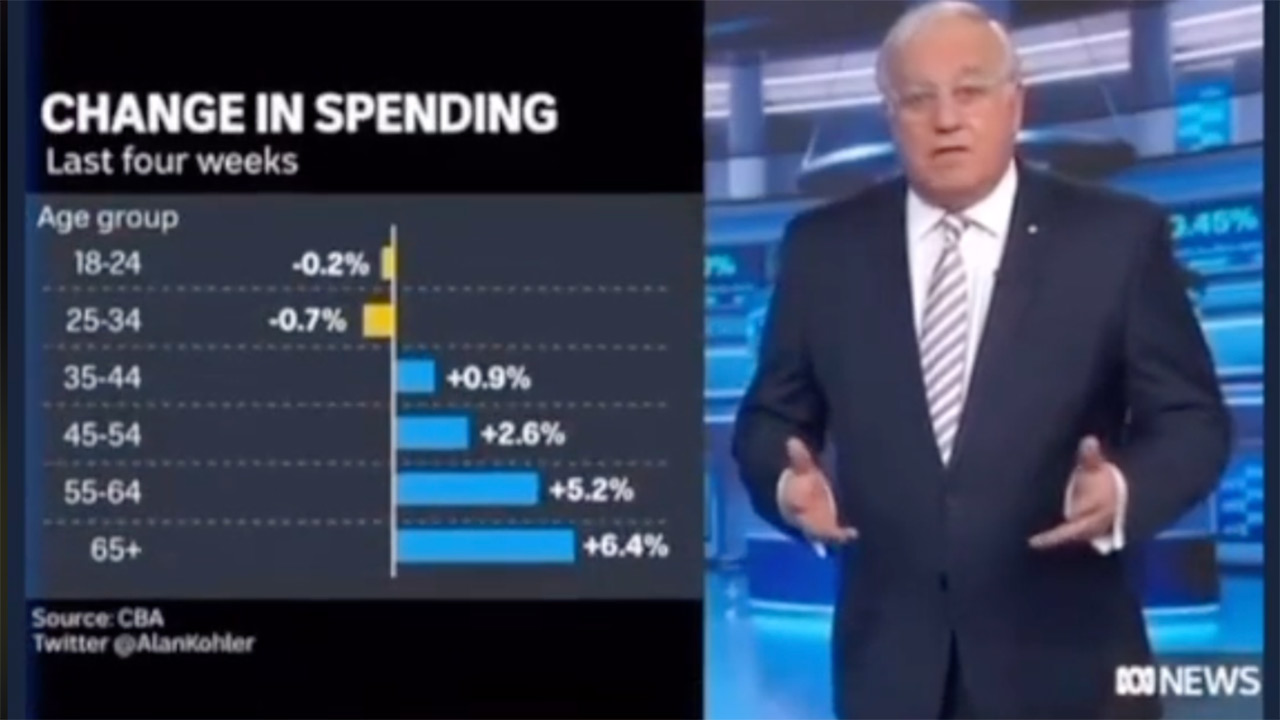

"Some interesting results from CBA's results presentation," observed ABC financial journalist Alan Kohler in a recent television appearance that has since gone viral. "They all highlight the great divide between generations."

Kohler presented data showing that Millennials have the most debt and "baby boomers have most of the savings", with young people drawing down on their limited savings while boomers continue to grow their nest eggs.

"And Gen Z and millennials are cutting back their spending and therefore doing all the hard work, helping the Reserve Bank get inflation down, but baby boomers are spending more and undermining that effort," Kohler explained. "So, sorry about that, kids."

Kos Samaras, director of research firm RedBridge Australia, echoed Kohler's sentiment, noting that millions of Australians are now in negative cash flow, struggling to make ends meet.

"It's a train wreck," Samaras asserted. "These households are not driving inflation. It's people like myself and much older. Spending from 50+ is up, savings are up, and higher interest rates equal higher earned interest on savings. It's also super profits and other international drivers."

PropTrack economist Angus Moore offered a more nuanced view, explaining that inflation is "never driven by a single thing or a single group."

"For the sake of simplifying it, the reason we're seeing high inflation is down to two things," Moore clarified.

"One is supply-led inflation, which is things like petrol and energy prices, disrupted supply chains driving up import costs, growth in construction costs, and so on.

"More recently in the past 18 months, we've seen the second cause emerge, which is demand-led inflation. Basically, the economy is broadly doing very well. Unemployment is the lowest it's been in five decades. That's helped to give people more money, which has supported spending – or demand-led inflation."

Amidst widespread financial hardship, corporations are reaping record profits, further fuelling public resentment.

Electricity prices surged by 4.2 per cent in September, reflecting higher wholesale costs being passed on to consumers. Origin Energy, one of the country's largest electricity suppliers, saw a staggering 83.5 per cent increase in profits in the 2022-23 financial year.

"The public have been told that supply chain issues and inflation are to blame for the cost-of-living crisis," said Joseph Mitchell, assistant secretary of the ACTU. "But when you see the profits like those posted, it is legitimate to ask whether Australia's big supermarkets have used the cost-of-living crisis as a smokescreen to push up their profit margins, despite costs decreasing for themselves."

Similarly, Australia's biggest insurer IAG, which owns NRMA and CGU among others, posted a net profit of $832 million in 2022-23, skyrocketing 140 per cent on the year prior.

"Insurance is an essential," Mitchell emphasised. "To protect our homes and to get to work we all have to pay those premiums. It's beyond the pale to expect hard working Australians to continue cop increases to life's essentials just to have big business creaming from the top."

The Australia Institute's Centre for Future Work is demanding price regulations across strategic sectors such as energy, housing and transport, as well as competition policy reform to restrain exploitative pricing practices.

"The evidence couldn't be any clearer – enormous corporate profits fuelled the inflationary crisis and remain too high for workers to claw back wage losses," stated Dr Jim Stanford, the centre's director.

"The usual suspects in the business community want to blame labour costs for inflation. That claim simply doesn't stack up under the weight of international and domestic evidence that shows corporate profits still account for the clear majority of excess inflation, despite inflation moderating from its peak last year."

Image: TikTok