Woman’s monthly spend sends shockwaves

A woman who earns a $100,000 salary has shocked people with how she budgets her generous pay cheque.

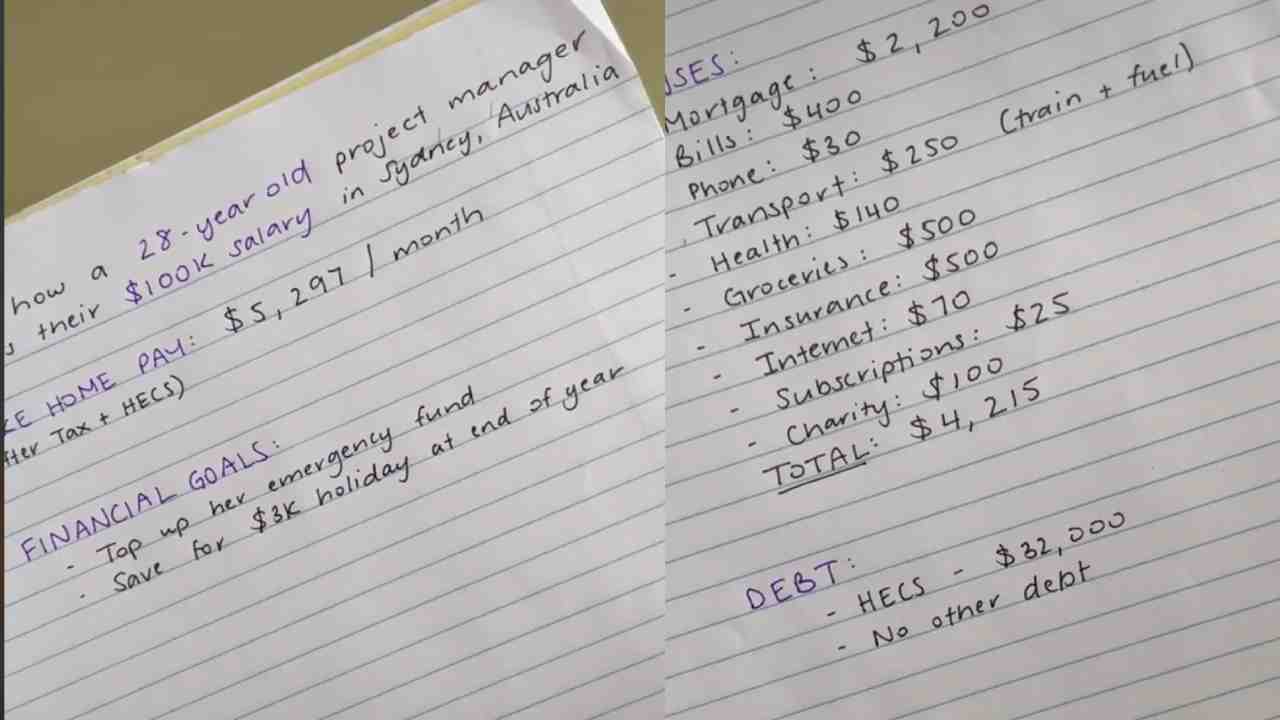

The video shared to TikTok by Smart Women Society breaks down the 28-year-old Sydney project manager’s spending.

After taxes, compulsory student loan payments (HECS) and superannuation, the woman was left with $5,297 a month.

The woman’s financial goal is to “top up emergency fund” as well as go on a lavish holiday at the expense of $3,000.

A list of all her expenses amount to $4,215 a month, with that pay going toward her mortgage, bills, transport, phone, groceries, health, insurance, internet, subscriptions and charity.

Broken down, the woman spends $2,200 on her mortgage, $400 on bills, $30 on her phone, $250 on transport and $140 on her health.

She also spends $500 in groceries, $500 in insurance, $70 for internet and $25 for subscriptions, and $100 given to charity.

The video noted that the woman only had her HECS debt of $32,000 which is already taken out of her pay.

This then leaves the woman with only $1,082 after paying all her expenses.

Smart Women Society suggested, based on her goals, that the woman put $300 toward her emergency fund, $400 for her end-of-year holiday, and $382 for “fun spending”.

Viewers were left shocked and confused at the anonymous woman’s spending habits, with many questioning why she is paying so much in charity and insurance.

“$382 for ‘fun’ in Sydney, is this a joke?” someone wrote.

“You’re young…$500 on insurance seems excessive,” another wrote.

“$300 spending? For the entire month? Good luck. Cost of fun in Sydney she’s going to need at least $300 a week,” a viewer pointed out.

“How is someone on $100k a year only left with $85 a week for personal spending? That's not even a night out in Sydney,” another joked.

“She should move out of Sydney,” someone suggested.

Images: TikTok