Super strategy that can make a difference

In this article Shane Bonke, Founder and Senior Financial Advisor at Lighthouse Consultants, writes about a clever, yet relatively unknown way seniors can maximise their superannuation return.

As we approach retirement, it’s important we do everything that we can to maximise the size of our nest egg so we can maintain a comfortable standard of living.

If you are 60 or over and still working, there is a superannuation strategy guaranteed to reduce your personal income and boost your superannuation savings.

And best of all, this particular financial strategy is not dependant on investment returns to be effective, instead cleverly taking advantage of the different tax rates afforded to your salary, and the income received from a superannuation income stream.

When we implement this strategy for our clients, the average tax saving is $5,000 in the first year alone. The best way to see how it works if with an example.

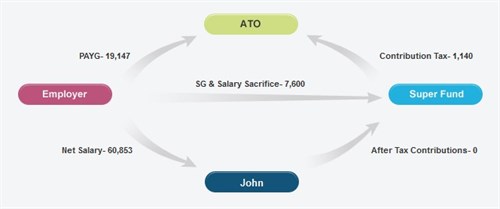

Take one of our clients, John. Currently, John is 60 and earns $80,000 a year before tax. John’s superannuation balance is $300,000 and his employer contributes the required amount of super each year. John’s financial situations breaks down as follows:

John's current position

You can see that John pays $19,147 in personal income tax and that leaves him with a take home pay of $60,853 each year.

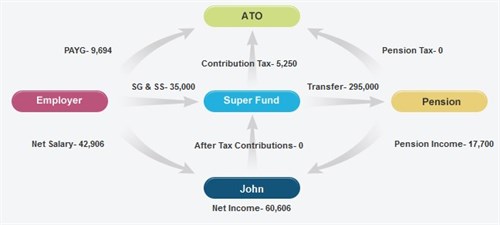

However, we were able to implement a transition to retirement strategy for him that made a huge difference to his personal income tax and eventual super balance. John’s position after the strategy was implemented looks like this:

John's position post strategy

The basis of the strategy was to transfer $295,000 of John’s super to an account based pension which would allow us to pay him a tax free payment. The next step was to start salary sacrificing part of his salary into his super, making the maximum allowable contribution of $35,000 each year. The final step was to calculate the pension payment for John to receive so that his take home pay remained the same.

You can see in the table below that we were able to keep John’s take home pay at effectively the same amount but increase his net super contributions by $5,590 in the first year alone.

John’s position after implementing strategy

- Net Income $60,853 – $60,606

- Net Super Contribution $6,460 –$12,050

Multiply this strategy over five years and you can see that this will make a big difference to John’s future superannuation balance.

For a short time, Over60 members can receive a special discounted price on initial consultations with Lighthouse Consultants. For more information click here.

Related links:

Understanding the Age Pension income test

How to take control of your finances in retirement

Why many retirees are choosing to sell their own home